Toronto, February 14, 2020

Pizza Pizza Royalty Corp. (the “Company”) and Pizza Pizza Limited (“PPL”) today announced that effective January 1, 2020, the number of restaurants on which royalties are paid to the Company by PPL (the “Royalty Pool”) has been adjusted to include 20 new restaurants opened during the prior year vend-in period, offset by 43 restaurants which were closed during the period. The majority of restaurants closed were nontraditional restaurants.

By brand, 19 new Pizza Pizza restaurants and one new Pizza 73 restaurant were added to the Royalty Pool; there were 34 Pizza Pizza restaurants and nine Pizza 73 restaurants closed and removed from the Royalty Pool. Of the 43 closures, 13 were traditional restaurants and 30 were nontraditional locations. Nontraditional restaurants, which have limited operating hours and a limited menu, are operated by licencees under licence agreements which can be based on shorter terms when compared to our traditional restaurant format.

For 2020, there will be 749 restaurants (2019 – 772) in the Royalty Pool made up of 645 Pizza Pizza locations and 104 Pizza 73 locations.

Historically, PPL has maintained a low restaurant closure rate. However, during the second half of 2019, with an enhanced focus on restaurant level profitability across the entire national network of locations, management began undertaking a review of underperforming traditional restaurants; the review is expected to continue into early 2020. Of the 30 nontraditional closures, 13 were operating in cinemas and six were in gas bars. Management anticipates returning to positive store growth in 2020 at both brands

The Company, indirectly through the Pizza Pizza Royalty Limited Partnership (the “Partnership”), owns the trademarks and trade names used by PPL in its Pizza Pizza and Pizza 73 restaurants. The Pizza Pizza trademarks and other intellectual property were licensed to PPL in 2005 for 99 years, for which PPL pays the Partnership a royalty equal to 6% of the System Sales of its Pizza Pizza restaurants in the Royalty Pool. In 2007, the Partnership acquired the trademarks and other intellectual property of Pizza 73 and licensed them to PPL for 99 years, for which PPL pays a royalty equal to 9% of the System Sales of the Pizza 73 restaurants in the Royalty Pool.

January 1, Royalty Pool Adjustment Date (the “Adjustment Date”)

Annually, on January 1, the Royalty Pool is adjusted to include the Forecasted System Sales from new restaurants added to the Royalty Pool net of System Sales from restaurants which were closed and removed from the Royalty Pool. The Forecasted System Sales from new restaurants added to the Royalty Pool may also be reduced by any decrease in system sales of a previously existing restaurant whose territory has been adjusted by a new restaurant. (See “Adjusted Restaurant” as defined in the Licence and Royalty Agreements).

In exchange for adding new restaurants to the Royalty Pool, PPL is compensated in equivalent Company shares (“Equivalent Shares”) using an agreed-upon formula which is designed to be accretive to current shareholders. Generally, when additional restaurants are added to the Royalty Pool, the forecasted increase to PPL’s System Sales (and thus, the Company’s royalty income) will result in an increase in PPL’s interest in the Company, reflected through an increase to the Class B and/or Class D Exchange Multipliers. Additional details about this formula can be found in Table 1 below and in the Company’s most recent Annual Information Form.

January 1, 2019 Royalty Pool Adjustment

In early January, 2020, a second adjustment was made to the royalty payments and PPL’s Class B Exchange Multiplier based on the actual performance of the 18 new restaurants added to the Royalty Pool on January 1, 2019. As a result of the adjustments, the Class B Exchange Multiplier is 2.117969 and Class B Units can be exchanged for 5,312,373 shares effective January 1, 2019.

In early January, 2020, a second adjustment was made to the royalty payments and PPL’s Class D Exchange Multiplier based on the actual performance of the seven Pizza 73 restaurants added to the Royalty Pool on January 1, 2019. As a result of the adjustments, the Class D Exchange Multiplier is 22.44976 and Class D Units can be exchanged for 2,244,976 shares effective January 1, 2019.

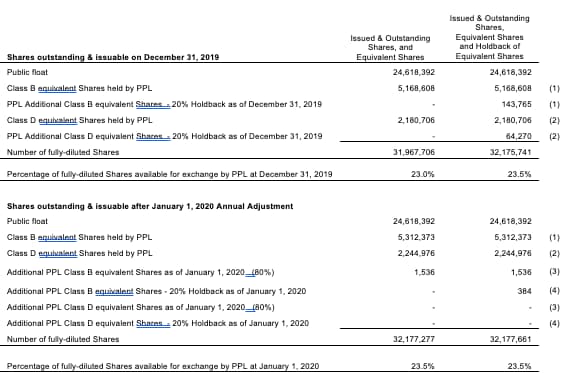

After the second adjustments to the January 1, 2019 Adjustment Date, PPL owns Equivalent Shares representing 23.5% of the Company’s fully diluted shares as shown in Table 1. Prior to this adjustment, PPL’s ownership was 23.0%. PPL’s ownership is through its holdings of Class B and Class D units of the Partnership, which are exchangeable for a number of Shares based on the Class B and Class D Exchange Multipliers.

January 1, 2020 Royalty Pool Adjustment

On January 1, 2020 Adjustment Date, in exchange for adding $38,000 of Forecasted System Sales from Pizza Pizza restaurants to the Royalty Pool ($8,725,000 from the 19 new Pizza Pizza restaurants less sales of $8,687,000 from 34 permanently closed Pizza Pizza restaurants), PPL has received 1,536 additional equivalent Shares (through the change to the Class B Exchange Multiplier). The additional equivalent Shares represent 80% of the forecasted equivalent Shares entitlement to be received (1,920 equivalent Shares represent 100%), with the final equivalent Shares entitlement to be determined when the actual sales of the new restaurants are known with certainty in early 2021.

Additionally, $345,000 of System Sales from Pizza 73 restaurants were removed from the Royalty Pool ($546,000 from the one new Pizza 73 restaurant less sales of $981,000 from the nine permanently closed Pizza 73 restaurants). Since the system sales of the closed Pizza 73 restaurants exceeded the additional system sales of the additional restaurant added to the Pizza 73 Royalty Pool, the Make-Whole Payment paid by PPL to the Partnership will be carried over, and continue to be paid for subsequent years, until on an Adjustment Date, additional system sales of additional restaurants are sufficient to offset the Pizza 73 system sales attributable to all closed Pizza 73 restaurants. Additionally, the January 1, 2020 adjustment date’s net estimated sales were further reduced by $1,446,000 in system sales attributable to certain restaurants previously added to the Royalty Pool whose territory adjusted a previously existing restaurant. As per the Pizza Pizza Royalty Limited Partnership agreement, whenever the Estimated Determined Amount is negative it shall be deemed to be zero. Accordingly, the Class D Exchange Multiplier remained unchanged at 22.44976. The second adjustment to the Class D Exchange Multiplier will be adjusted to be effective January 1, 2020, once the actual performance of the new restaurants is determined in early 2021.

Table 1 – Summary of the Company’s Outstanding and Fully-Diluted Shares, including an analysis before and after the 20% entitlement holdback:

(1) In early January 2020, adjustments to royalty payments and PPL’s Class B Exchange Multiplier were made based on the actual performance of the 18 new restaurants added to the Royalty Pool on January 1, 2019. As a result of the adjustments, the new Class B Exchange Multiplier is 2.117969 and Class B Units can be exchanged for 5,312,373 shares, effective January 1, 2019.

(2) In early January 2020, adjustments to royalty payments and PPL’s Class D Exchange Multiplier were made based on the actual performance of the seven Pizza 73 restaurants added to the Royalty Pool on January 1, 2019. As a result of the adjustments, the new Class D Exchange Multiplier is 22.44976 and Class D Units can be exchanged for 2,244,976 shares effective January 1, 2019.

(3) Additional Class B and Class D equivalent Shares available January 1, 2020 are shown in the table and determined by the following three steps:

(a) Determined Amount = 92.5% x (1-Tax%) x [(Additional System Sales of Additional Restaurants – System Sales of Closed Restaurants) x Royalty rate]

Share Yield

(b) Exchange Multiplier increase = (80% of Determined Amount / Market Price of Shares determined on the Adjustment Date)

Class B or D Partnership Units Outstanding

(c) Issuable Equivalent Shares = Exchange Multiplier increase amount x Class B or D Partnership Units Outstanding

New Class B Exchange Multiplier = 2.118582

Tax % = 22.3%

Net Additional System Sales = $38,000

Royalty rate = 6%

Share yield = 8.97%

Class B Partnership Units Outstanding = 2,508,239

New Class D Exchange Multiplier = 22.44976

Tax % = 22.3%

Net Additional System Sales = $(345,000)

Royalty rate = 9%

Share yield = 8.97%

Class D Partnership Units Outstanding = 100,000

(4) A preliminary calculation of the 20% holdback of equivalent Shares was done as of January 1, 2020 using the net, 2020 Forecasted Sales. The final Class B and D equivalent Shares entitlement will be determined in early 2021, effective January 1, 2020 once actual sales of the restaurants are known.

Forward-Looking Statements

Certain statements in this press release, including those concerning Forecasted Sales performance of new restaurants and related adjustments to the Exchange Multipliers, may constitute “forward-looking” statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

When used in this press release, such statements include such words as “may”, “will”, “expect”, “believe”, “plan”, and other similar terminology in conjunction with a discussion of future operating or financial performance. These statements reflect management’s current expectations regarding future events and operating performance of the restaurants added to the Royalty Pool and speak only as of the date of this press release. Material factors or assumptions reflected in the presentation of Forecasted Additional System Sales include: demographic and competitive studies, historical sales performance of similar stores and economic forecasts for the retail industry. These forward-looking statements involve a number of risks and uncertainties. The following are some factors that could affect the forecasted performance of these restaurants, causing actual results to differ materially from those expressed in or underlying such forward-looking statements: competition, the store owner’s performance, changes in demographic trends, changing consumer preferences and discretionary spending patterns, changes in national and local business and economic conditions, and legislation and governmental regulation. These factors could also affect PPL’s ability to develop new restaurants. The foregoing list of factors is not exhaustive and should be considered in conjunction with the other risks and uncertainties described in the Company’s most recent Annual Information Form. The Company assumes no obligation to update these forward-looking statements, except as required by applicable securities laws.

For further information:

Christine D’Sylva, Vice President Finance & Investor Relations, Pizza Pizza Limited

Telephone: (416) 967-1010 extension 393